If you really want to supercharge your career, gain a higher salary, and make an impact in your chosen field, you may want to consider pursuing a master’s degree.

A master’s degree is an advanced postgraduate qualification that demonstrates your mastery of a specific field of study or professional practice. And the only place you’re going to earn a master’s degree is at grad school.

Unfortunately, there’s no such thing as a free lunch. Grad school has the power to drastically enhance your career opportunities. But as you might imagine, grad school tuition tends not to be cheap, either.

This guide will explain why grad school is a smart investment and exactly how to pay for grad school.

Is grad school a good investment?

Paying for college isn’t always easy — but if you’re considering going back to school in order to earn your master’s degree, you already know that.

However, if you’d like to boost your chances of employment and increase your salary potential, the numbers say that pursuing a postgraduate degree at grad school is a wise place to start.

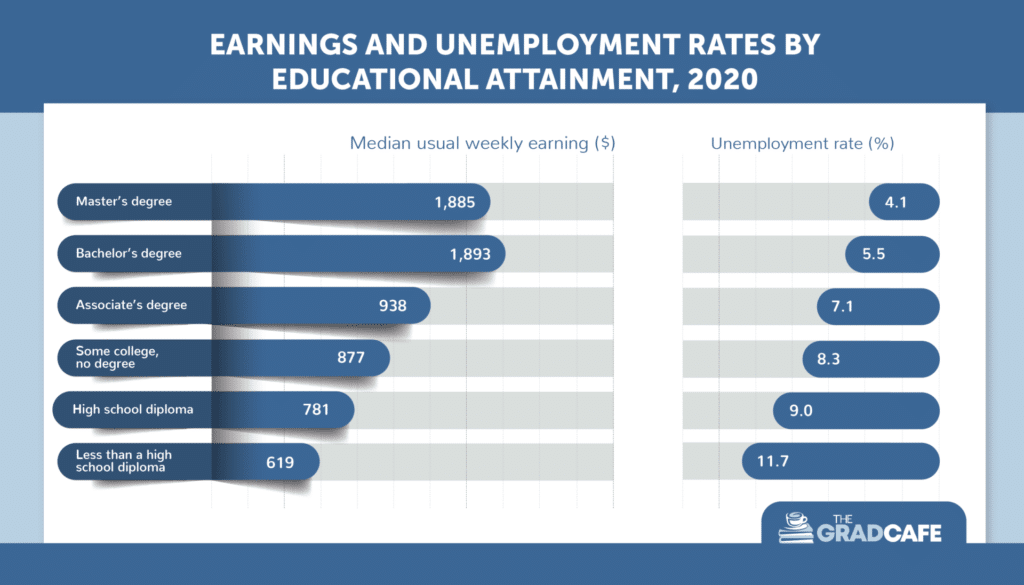

According to a research by the Bureau of Labor Statistics, the average median weekly earnings for a person with a master’s degree is $1,545. Meanwhile, the average weekly salary for somebody with only a bachelor’s degree comes in at just $1,305. Workers with only a high school diploma are looking at a salary of just $781 per week.

Surveys also suggest that grad school drastically reduces your risk of unemployment.

If you’ve got a master’s degree, you’re almost 20% more likely to gain employment than people with a normal undergraduate degree alone.

Why does grad school increase your chances of employment?

Above all else, achieving a master’s degree demonstrates to prospective employers how dedicated you are and how much time and energy you’re willing to devote to developing new skills and honing your craft. Likewise, grad school programs empower you with specialist, research-driven knowledge that separates you from the pack where hiring pools are concerned.

All in all: grad school is a good investment, statistically speaking. But as we’ve already pointed out, it’s not the cheapest, either.

A master’s program at Brown University in 2021/22 will set you back $60,944 per academic year. A postgraduate program at Duke costs $28,950 per semester. Even a school like the University of Kansas will come in at around $24,430 per year for a typical grad school program.

Most of us haven’t got that much cash lying around. Fortunately, there are plenty of funding options you may be eligible for that can be used to pay for grad school.

Before you begin, consider your situation

As you start considering graduate school, one of the best things you can do is look at your financial situation. Consider the estimated costs of tuition and living expenses for your specific schools and programs, then look at your finances. Ask yourself a few questions, such as the ones below.

- How much do you need in total?

- Do you have the means to cover part or all of your estimated costs from savings or from current employment?

- Does your current employer offer any educational benefits that can pay for part or all of your tuition?

- Do you have other debts to worry about?

- How was your previous academic performance?

- Do you have a good CV?

- Can you find a school or program that offers tuition remission and living stipends?

The answers to these questions can help determine what type of financial aid should look to obtain. Having a better idea of your situation in general can help you figure out how to get graduate school paid for. You might even benefit from writing down your answers so you can refer to them as you look for schools and financial aid.

How to pay for graduate school

When it comes to paying for grad school, there’s no right way or wrong way. No two students are alike, and so the way you ultimately fund your postgraduate studies will be different from the person sitting next to you in class.

Each grad school funding option comes with its own set of pros and cons. To help you get started, we’ll break down a few of the most common ways to pay for grad school.

Do your research

Before you even begin applying for any forms of financial aid, you can start by doing your research. You can look for ways to pay for grad school, and by that, we mean the type of options that are available to you.

Do some research into your field of choice and look for programs of interest. Find out how much it costs to attend those programs and get an estimate of your living expenses during your education. Look into whether the program is flexible enough to allow you to work part-time or find an assistantship position.

If you have loans you are currently repaying, you can research whether it is possible to defer them for the duration of your graduate school — though you may want to be careful as your debt may still accrue interest during this time. You can also do some research on whether it’s possible to refinance them (we’ll talk more about this below).

Take notes of everything you find if you must — it’s never bad to have a reference to look at along the way!

Look for money you won’t have to pay back

One of the best things you can do when it comes to paying for graduate school is to look for money that you won’t have to pay back. This ‘free’ money can really come in clutch and make your life a lot easier in the long run by lessening any debts you have to pay. It can come from your savings, although it’s understandable if you don’t necessarily want to dip into your rainy-day funds. It can also come in the form of scholarships, grants, and fellowships. We’ll take a deeper look into them below.

Scholarships, Grants, and Fellowships

Most graduate schools offer financial aid in the form of scholarships, fellowships, and grants. These can cover all or part of your studies and are not repayable.

Grants are usually based on needs. Scholarships and fellowships, on the other hand, are based on a combination of needs and merits.

You need to do your research. Find out what your graduate school offers, which scholarships apply to your academic department, and which stem from a central financial aid office. Depending on what you study, you may also qualify for financial aid from several public or private organizations.

Most importantly, note that scholarships, fellowships, and grants are extremely competitive! So, apply as early as possible to obtain the maximum benefit you can.

To make a start, you can have a look at grants.gov and Peterson’s.

You can always ask the admissions or department heads at your program for info on grants, scholarships, and fellowships that have helped grad students before you.

Other than the scholarships, grants, and fellowships available at your programs and schools of choice, there are also some available from outside sources. Depending on your field of interest, you may be qualified for grants, scholarships, and fellowships from private entities and non-profit organizations that are not associated with your school. These may be called ‘outside’ fellowships/scholarships on some schools’ websites.

Outside scholarships can come from private and non-profit organizations or professional associations within your field. Professional associations may also have the resources to help you find funding.

Employer Support

It may (or may not) come as a surprise that some jobs can actually help pay for your grad school. Many companies offer this benefit to attract new employees and train talent. Let’s take a look at some of these companies:

- UPS offers one of the best tuition reimbursement programs that can help employees pay for their education. According to the company, the Earn & Learn program has helped pay for the tuition of 290,000 employees to date. Full-time employees get the most benefits, though the amount varies from case to case. However, part-time employees can also claim this benefit.

- Intel offers an extremely generous reimbursement package to its over 110,000 employees. The tech behemoth offers employees as much as $50,000 towards their graduate program, with no annual limit to the amount. Granted, Intel does just provide excellent benefits overall, and even has scholarships available for their employees’ children.

- Best Buy actually has a tuition reimbursement program that offers qualifying employees a maximum of $3,500 per calendar year for undergrads and $5,250 per calendar year for graduate students.

It’s worth noting that even smaller businesses can offer tuition reimbursement as these benefits are not exclusive to large corporations. There’s no harm in asking your manager/boss or human resources representative to find out if it’s a benefit on offer.

Save money

If you have the means and you’re working with a long enough timeline, one of the best ways to fund your grad school program is by saving. By saving money for your tuition, you won’t have to take out a long-term loan, bother applying for scholarships, or ask your employer for help.

But for most of us, saving cash is a lot easier said than done. That’s where investment vehicles like 529 plans come in.

A 529 plan is a tax-advantaged investment account that allows individuals to save for future college expenses.

Parents typically set up a 529 account for a child when they’re relatively young and make regular contributions over several years. By the time that child is out of secondary school and ready for college, the 529 account should then be big enough to put a pretty big dent in that child’s college tuition.

Although 529s are most commonly used for undergraduate studies, they can be used to save for grad school, too.

One of the major advantages of saving with a 529 is that all the withdrawals you make for higher education expenses or tuition are not subject to federal income tax. That being said, there are rigid rules around what constitutes a qualified education expense.

These rules vary from state to state — so before starting a 529 for yourself or your child, you should do your homework to make sure you understand how you can use it.

Work for the graduate school

Another great way to help you pay for grad school is to work for the institution itself.

Most colleges offer teaching and research assistantships that provide funding to master’s students when they spend time working for the grad school in a research or teaching capacity.

These assistantships are also often called studentships.

Funding for grad school studentships will often be generated from a particular departmental or supervisor’s budget — but external funding bodies also often form partnerships with grad schools to fund studentships.

While studentships don’t need to be repaid, it’s important to bear in mind that you’ve got to work for the funding. You’ll be expected to carry out specific teaching responsibilities or activities, which are normally specified in a contract.

That being said, studentships are also a fantastic way to develop new skills.

Federal student loans

Although grants and studentships are fairly common, a large number of graduate students tend to rely on federal student loans to pay for their master’s tuition.

If you’re studying toward a postgraduate degree, you can borrow up to $20,500 per year in Direct Unsubsidized loans. Unlike a subsidized loan, an unsubsidized federal loan requires you to pay back the interest on the tuition fees you borrow.

That being said, if your grad school expenses exceed the institutional cap on your Direct Unsubsidized loan, you’ll normally be able to pay for the remainder of your costs using a Direct PLUS loan.

The amount of money you can borrow using a Direct PLUS loan will depend on the cost of attendance at your particular school. The amount of financial aid you receive will then be subtracted from that cost of attendance to establish a loan cap.

You can apply for a federal grad school loan online through the William D. Ford Federal Direct Loan Program.

Private student loans

If for some reason, you’re unable to secure a federal student loan, you can always apply for a private student loan. There are a range of mainstream banks and lenders that offer graduate student loans.

But there are a couple of important points you’ve got to bear in mind where private student loans are concerned.

Unlike subsidized federal loans, most private student loans will require you to start paying interest on the amount you borrow from the second that money touches your bank account.

Likewise, many federal student loan programs include loan forgiveness clauses that effectively write off the remainder of your student debt after a certain number of years.

That being said, private student loans do tend to offer master’s students a direct and effective pathway to funding their studies.

Military benefits

If you’ve served in the military or are currently serving, you can also use military benefits to pay for grad school.

There are a range of benefit options available, but one of the most popular options is via the Post-9/11 Veterans Educational Assistance Act of 2008.

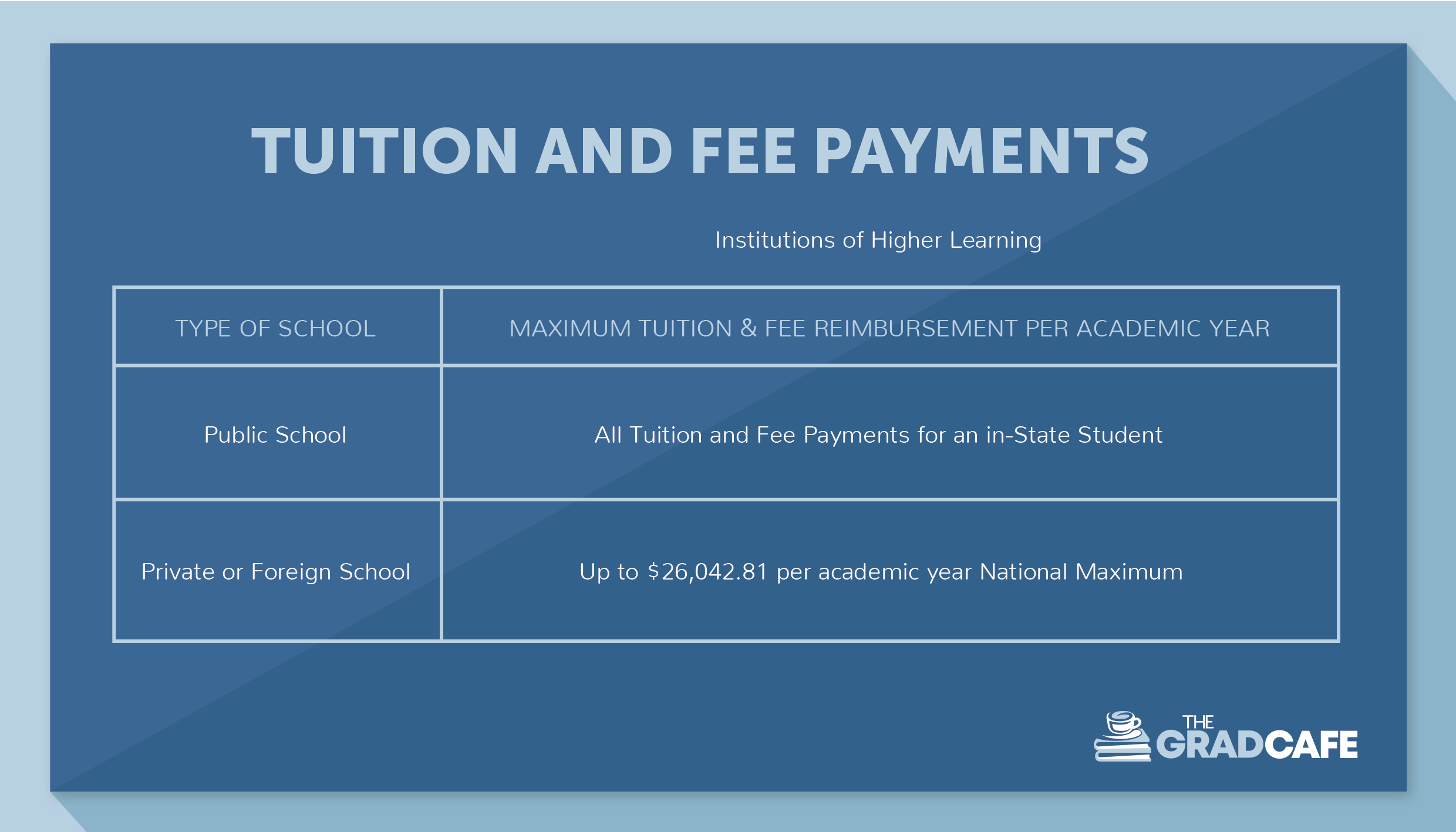

Through the Post-9/11 GI Bill, the United States Department of Veterans Affairs (VA) will pay for 36 months, or the full cost of in-state grad school tuition and fees — assuming you qualify for 100% benefits.

The payment you receive from the VA for grad school will depend on information from your college or university that lets the VA know how much “training time” you’re carrying out.

Tips for paying for graduate school

At the end of the day, there’s plenty of grad school funding opportunities available, depending on your eligibility. But if you’re trying to maximize your chances of receiving financial aid and paying for grad school, there are a few tips worth considering.

Apply early

Like it or not, a large proportion of grad school funding is awarded on a first-come, first-served basis. That means if you want to be considered for a particular scholarship, studentship, or grant, you’ve got to apply as soon as possible.

Similarly, most scholarship programs and federal student loans include strict application deadlines that you can’t afford to miss.

Talk to your school’s financial aid office

You know what they say about “those who don’t ask,” right? Well, the same rule applies to grad school funding.

Your college or university will likely have a number of funding options available to you that you may be unaware of. The best way to find out about those opportunities is to get in touch with your school’s financial aid office and ask what options you may be eligible for.

Shop around for the best price

If you’re considering a private student loan, shopping around is absolutely critical. Each lender will likely be offering you a different interest rate or loan terms. Some of those terms might sound great at first glance — but if you really crunch the numbers and consider your finances, you may end up seeing things a little bit differently.

You should discuss grad school loan products with a number of lenders, ask questions, and compare each loan against other contenders before you sign anything. This will ensure you get the best possible deal.

Choose an accelerated program

Another way to save money on grad school is by pursuing an accelerated master’s program.

An accelerated program allows undergraduates to earn their bachelor’s degree and master’s degree at the same time. This saves students both time and money. If you’ve got a clear vision for your long-term academic plans, it could be worth considering working toward both degrees at once.

Figure out your grad school ROI

Before you start working to pay for grad school, it’s always worthwhile to figure out your grad school return on investment (ROI).

There are loads of online grad school ROI calculators worth checking out, but the process of working this out is relatively simple.

First, calculate the cost of the postgraduate program you’re considering. Then you’ve got to develop a conservative estimate of your first year’s salary after finishing grad school. Finally, subtract that salary from the sum of any outstanding debt for your undergraduate studies and projected grad school debt.

If your post grad school salary is higher than your projected debts, you can argue that the master’s program you’re looking at offers a positive ROI. If you’re going to end up owing more in debt than you’re making, it could be worth reconsidering your options.

Consider student loan forgiveness

One of the most useful aspects of taking out a federal student loan to pay for grad school is loan forgiveness.

The government’s Public Service Loan Forgiveness (PSLF) Program writes off the remaining balance of your federal student loan after you’ve made 120 monthly payments under a repayment plan. To be eligible for loan forgiveness, you’ll normally need to be working full-time for a qualifying employer.

You can learn more about your eligibility for loan forgiveness online using the PSLF Help Tool.

Steps to take before applying to grad school

After you’ve looked into the question “how do you pay for grad school?” it’s a good idea to make a plan for applying to your chosen schools and programs. No matter how long it’s been since you’ve last applied to colleges for your undergraduate degree, you can probably still remember how the process went. Once you’ve put together a plan for your finances during your education, you can start preparing to apply to graduate school. The tips below can help you get ready.

- Make your school lists. By that, we mean putting together three lists. One list for your dream schools, which are the super-competitive or expensive programs you’d love to get into. Then you can make another list for your target schools, the ones you are confident enough you’ll get into. Finally, you can list your safety schools, which are the ones you know you’ll get into because you exceed the requirements for admission. Start considering which ones you want to apply to.

- Do your research and create your plan. Once you’ve got your lists, you can start doing deeper research into the programs, their costs, admissions requirements, and any other relevant details you may need to note, such as application deadlines. Every school has different deadlines and requirements, so it may help you to note the dates on your calendar (or you can make a spreadsheet to help you keep track).

- Take standardized tests if your program/school asks for scores. Although more and more graduate schools have begun dropping the requirement for standardized test results, many still ask for GMAT or GRE scores. Find out whether you need to take these exams to apply to your chosen schools. If you do, you can do some test prep on your own or through paid programs. You can also take practice tests to help you get ready.

- Start preparing letters of recommendation. Because these letters are essentially favors done for you, always make sure that you give your recommenders plenty of time to get them done. Aim for at least a couple of months of lead time, since people you ask for recommendations can be quite busy with their own responsibilities. You can ask former professors, supervisors and bosses at your job, colleagues, and people at non-profits you’ve volunteered with who know your skills, work ethic, and dedication.

- Write your personal statement. Your personal statement, sometimes also known as your admissions essay, can be quite impactful to your admission. Take ample time to write it as it can give admissions offices a peek at who you really are beyond your academic performance. It is here that you can showcase your personality and individuality. Often, personal statements inform admissions officers whether an applicant would be a good fit for the program’s culture and values. It’s a good idea to tailor your personal statements to each program and school you apply for, especially since admissions officers can generally find out whether you’re using a canned essay across multiple applications.

- Gather the rest of your requirements. As the time to apply gets closer, it’s time for you to gather the rest of the requirements. Acquire your official college transcripts and get them sent to the appropriate offices. Create your portfolio to showcase your abilities and experience, especially if you’ve spent a few years working prior to grad school. Finally, compile your applications and start double-checking everything before sending them out.

Once you’re done, the next step to take is simply to apply. From there, you’ll then have to wait to hear back — good luck!

Frequently Asked Questions

How can I pay for grad school with no money?

First and foremost, if you find yourself in this situation, you are not alone. Countless others stand with you, wanting to attend grad school but feeling like they have no funds. If you’re wondering how to afford grad school, fortunately, you do have some options.

Even if you do not have savings or if your current income cannot support your education, you can try:

- Applying for scholarships, fellowships, and grants

- Applying for federal aid (FAFSA)

- Taking out loans for the remainder of your costs (if any)

If you’re lucky enough, your current employer may offer some support for your graduate education.

You may also qualify for funding packages from your school that can cover part if not all of your grad school costs. Some programs also offer complete funding packages that include tuition remission (the school essentially pays you to attend) and, sometimes, a stipend for living expenses.

Does FAFSA pay for graduate school?

Yes. Filing for Free Application for Federal Student Aid as a graduate student is a similar experience to applying as an undergraduate. You’ll need your bank account information, tax returns, and details on whatever investments you may have.

Can I go to grad school with no money?

Many often wonder how to pay for grad school with no money. It won’t be easy, but it is possible. It’s worth mentioning that many financial awards and packages are merit-based, so the better your previous academic performance, the better your chances.

Seek programs or schools offering generous financial aid or funding packages with tuition remission. Alternatively, you can look for programs or schools that provide assistantships (teaching or research) that can cover part, if not all, of your tuition. It may also help you to look for options that provide you with stipends for your living expenses. If you don’t find any programs or schools like those in your field of interest, you can apply for various forms of financial aid.

The last two options are taking out loans and finding part-time employment as you study. However, employment may not always be the best option for financing graduate school. Part-time employment doesn’t usually pay much, and the time commitment can take away from your focus on your education.

How do most graduate students pay for school?

You’ve probably asked the question, “how do people pay for grad school?” once or twice in the past. There is no single best way to pay for grad school, as everyone’s situation is different. Many of the scholarships and grants available are often need-based, meaning they go to those with more financial need. However, they can also be merit-based, meaning they go to those who have earned them through high academic performance. Fellowships, on the other hand, are typically merit-based.

Most grad students pay for school with their savings (if any) or with some assistance from their current employer if they are lucky enough. They can also pay through a combination of scholarships, grants, and fellowships that they have qualified for. There’s also the FAFSA, loans, and work-study.

Some students are able to get into programs with tuition remission and living stipend provisions.

Many negotiate their funding packages with their schools to get a lower tuition cost.

How do I ask for more financial aid for grad school?

It can feel quite uncomfortable to ask or even broach this topic with your school, but taking the initiative to ask anyway can get you some great results. To start, you can ask admissions or your department how you can get more funding or if it is possible to improve your funding package. Barring that, you can ask them for recommendations for any other financial aid or opportunities you can apply for.

It’s important to remember that you should ask nicely as this will often get you better results. For example, instead of asking your school what they can do for you, you can say that you want things to work, so how can you and the school make it work?

Conclusion

At the end of the day, going to grad school increases your chances of landing a job and getting a higher salary — but postgraduate tuition doesn’t come cheap.

Fortunately, there are plenty of available options you can use to pay for grad school. Funding sources range from tuition assistance and scholarships to 529 plans, grants, loans, and more. But the funding option that you ultimately choose has got to depend on the course you choose, your time horizon, financial means, and long-term career goals.

That’s why you’ve got to do your homework and take your time considering your grad school funding options.

Want to learn more about how to pay for grad school? You’ve come to the right place. Check out TheGradCafe.com for more information about funding your master’s, including tips, tricks, and more.

Chriselle has been a passionate professional content writer for over 10 years. She writes educational content for The Grad Cafe, Productivity Spot, The College Monk, and other digital publications. When she isn't busy writing, she spends her time streaming video games and learning new skills.